Central banks, the powerful stewards of a nation’s economic health, wield formidable tools that not only influence domestic macroeconomic landscapes but also send ripples across the global monetary ecosystem. Among the most impactful of these tools are their monetary policy decisions, which can significantly affect currency values and, consequently, shape the world of foreign exchange (forex) trading. Understanding this intricate relationship is crucial for both seasoned traders and those dipping their toes into the dynamic forex market.

The Currency Value Equation

At the heart of it all lies the fundamental principle of supply and demand. Higher demand for a currency pushes its price up, while a decrease generates a price depreciation. Central bank decisions directly impact this equation by influencing both sides:

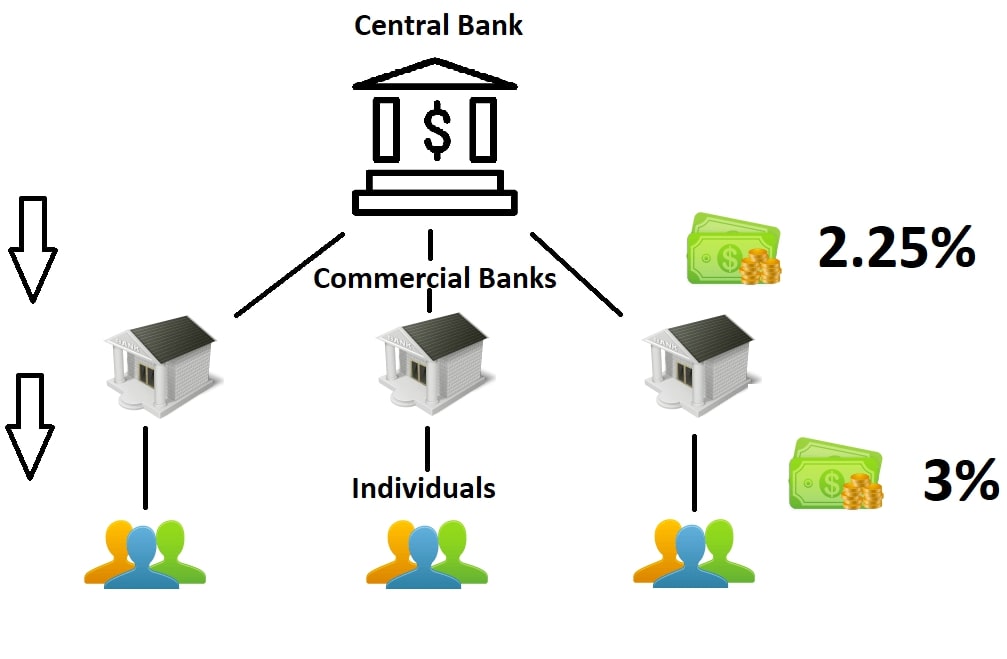

- Interest Rates: A central bank’s primary instrument is the adjustment of interest rates. When rates are raised, borrowing becomes more expensive, potentially dampening economic activity. This incentivizes investors to park their funds in that country’s assets, seeking the higher returns offered by its bonds and other interest-bearing instruments. This increased demand strengthens the currency’s value. Conversely, lowering interest rates makes borrowing cheaper, stimulating economic activity but potentially decreasing the relative attractiveness of holding that currency compared to others, leading to depreciation.

- Quantitative Easing (QE): In situations of economic slowdown or financial crisis, central banks may resort to unconventional measures like quantitative easing. This involves injecting liquidity into the financial system by purchasing government bonds and other securities. This increases the money supply, potentially weakening the currency through inflation and reduced relative attractiveness. However, QE can also boost asset prices and economic activity, depending on the specific circumstances.

- Foreign Exchange Intervention: While less common in recent years, central banks can directly intervene in the forex market by buying or selling their own currency to influence its value. This is typically done to counter significant market fluctuations or maintain certain exchange rate targets.

Trading Strategies in the Central Bank Maze

Understanding how central bank decisions affect currency values empowers forex traders to develop informed strategies:

- Fundamental Analysis: By closely monitoring central bank announcements, economic data releases, and policy statements, traders can anticipate potential shifts in monetary policy and their impact on currency values. This analysis forms the basis for long-term positions and directional trades.

- Technical Analysis: Technical indicators and chart patterns can provide valuable insights into market sentiment and potential breakout points, especially in the short-term. Combining this analysis with fundamental understanding of central bank signals can help refine entry and exit points for trades.

- Carry Trade: This strategy involves borrowing in a low-interest currency and exchanging it for a high-interest currency, profiting from the interest rate differential. However, central bank policy decisions in either currency can disrupt this strategy, so careful risk management is crucial.

- Hedging: When holding positions in foreign assets, central bank decisions in the relevant countries can introduce significant risk. Hedging strategies, such as using options or derivatives, can help mitigate this risk.

Central Banks and the Global Village

It’s important to remember that central bank decisions rarely occur in isolation. Global economic interconnectedness means that decisions by one central bank can have spillover effects on other currencies and economies. Therefore, a comprehensive understanding of the global economic landscape and the actions of major central banks is essential for navigating the complex world of forex trading.

Beyond the Toolkit

While analyzing central bank decisions and economic data forms a core aspect of successful forex trading, it’s not the only ingredient in the recipe. Discipline, risk management, and a solid understanding of trading psychology are equally important for navigating the ever-shifting winds of the forex market.

Central banks may seem like remote entities, but their decisions are woven into the very fabric of global financial markets. Understanding how these decisions impact currency values and trading strategies empowers traders to navigate the forex market with greater confidence and potentially reap the rewards of informed speculation. Remember, knowledge is power, and in the dynamic world of forex, knowledge of central bank moves can be the key to unlocking profitable opportunities.

Let’s Manage Your Forex Funds With Fx Pips Guru!

Fx Pips Guru is a forex fund management company managing client’s funds based on monthly profit share. Let’s do Live Chat with our experts.