The foreign exchange market, commonly known as the Forex market, is the largest and most liquid financial market in the world. It operates 24 hours a day, five days a week, allowing traders to engage in currency trading across different time zones. One of the key factors influencing Forex prices is market sentiment. Understanding how market sentiment affects currency values and being able to gauge it effectively are crucial skills for successful forex trading.

I. What is Market Sentiment?

Market sentiment refers to the overall attitude or feeling of traders and investors toward a particular financial market or asset. In the context of the Forex market, sentiment represents the collective opinion of market participants regarding the future direction of currency prices. It is driven by a combination of fundamental, technical, and psychological factors that shape traders’ perceptions and decisions.

II. The Influence of Market Sentiment on Forex Prices

- Impact on Price Trends: Market sentiment plays a significant role in determining the prevailing trends in the forex market. Positive sentiment can drive an uptrend, while negative sentiment may lead to a downtrend. Traders often follow the trend to capitalize on market sentiment-driven price movements.

- Volatility and Risk Appetite: Sentiment influences the level of market volatility. When sentiment is optimistic, traders are more willing to take risks, leading to increased volatility. Conversely, a pessimistic sentiment tends to result in a more risk-averse environment, reducing volatility. Understanding these shifts in risk appetite is crucial for forex traders seeking to manage their positions effectively.

- Impact of Economic Data Releases: Economic indicators and data releases can significantly shape market sentiment. Positive economic data, such as strong GDP growth or low unemployment rates, tends to boost confidence and create positive sentiment toward a currency. Conversely, negative economic data can lead to a shift in sentiment and impact currency prices negatively.

- Central Bank Actions: Central banks play a crucial role in shaping market sentiment through their monetary policies. Interest rate decisions, quantitative easing programs, and forward guidance from central banks can all influence the perception of traders and impact the value of a currency. For example, a hawkish stance (indicating a willingness to raise interest rates) can create a positive sentiment, while a dovish stance (indicating a preference for lower rates) may generate a negative sentiment.

III. Gauging Market Sentiment in Forex

- Technical Analysis: Technical analysis involves studying price charts and trading volumes to identify trends and potential reversal points. Traders often use technical indicators such as moving averages, relative strength index (RSI), and Fibonacci retracement levels to gauge market sentiment. For example, a series of higher highs and higher lows on a price chart may indicate positive sentiment and an uptrend.

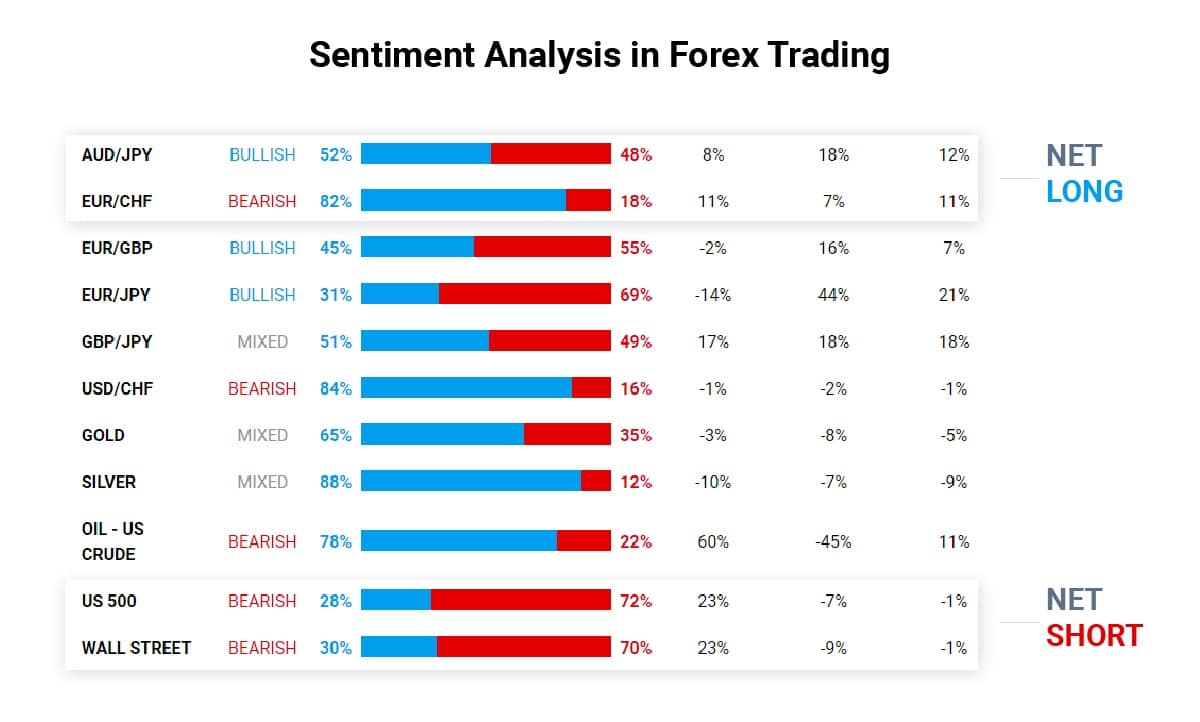

- Sentiment Indicators: Various sentiment indicators are available to forex traders, providing insights into the positioning and opinions of market participants. The Commitment of Traders (COT) report, for instance, provides information about the positions of large institutional traders and can offer clues about overall market sentiment. Additionally, sentiment indexes from retail trading platforms can indicate whether the majority of retail traders are bullish or bearish on a particular currency.

- Economic Indicators and News Releases: Monitoring economic indicators and news releases is essential for understanding market sentiment. Positive economic data, such as employment reports or GDP growth, can boost sentiment, while negative data may lead to a shift in sentiment. Additionally, geopolitical events and global economic developments can influence sentiment and impact currency prices.

- Social Media and Market Commentary: The advent of social media has brought a new dimension to gauging market sentiment. Traders often share their opinions and insights on platforms like Twitter and financial forums. Monitoring social media channels and market commentary can provide a real-time glimpse into the sentiment prevailing among retail traders and smaller market participants.

- Market Sentiment Index Tools: Several tools and platforms offer market sentiment indices that aggregate data from various sources to provide a comprehensive view of sentiment. These indices may include data from news sentiment analysis, social media, and trading activity. Traders can use these tools to gain insights into whether the market sentiment is leaning towards bullish or bearish.

In the dynamic world of forex trading, understanding and gauging market sentiment are crucial components for making informed decisions. Market sentiment, driven by a combination of factors, influences currency prices and can lead to significant price movements. Traders who can effectively analyze and interpret sentiment indicators, economic data, and other relevant information are better positioned to navigate the complexities of the forex market and capitalize on potential trading opportunities. As with any financial market, risk management remains paramount, and traders should use a combination of tools and strategies to enhance their ability to interpret and act upon market sentiment.

Let’s Manage Your Forex Funds With Fx Pips Guru!

Fx Pips Guru is a forex fund management company managing client’s funds based on monthly profit share. Let’s do Live Chat with our experts.