Forex trading, also known as foreign exchange trading or currency trading, is a global market where currencies are traded against each other. It’s a highly liquid and volatile market, making it appealing to traders seeking opportunities to profit from price fluctuations. One of the key concepts in forex trading is support and resistance levels. These levels are important because they help traders identify potential entry and exit points for their trades. In this article, we’ll explore the significance of support and resistance levels in forex trading.

Understanding Support and Resistance Levels

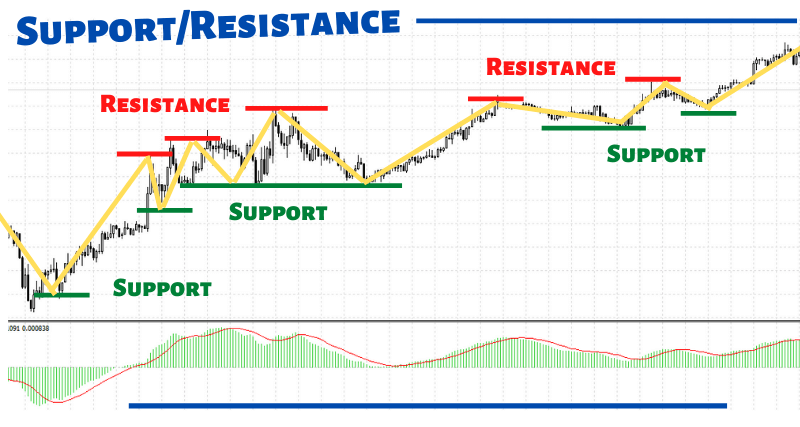

Support and resistance levels are two critical concepts in technical analysis, a method of analyzing financial markets based on historical price data. Support is a price level where a downtrend is expected to pause due to a concentration of demand. It is often viewed as a “floor” that prevents the price from falling further. On the other hand, resistance is a price level where an uptrend is expected to pause due to a concentration of supply. It is often seen as a “ceiling” that prevents the price from rising further.

Support and resistance levels are not fixed values but rather dynamic areas on a price chart. They are formed based on previous price action and can shift over time as new information becomes available. Traders use various technical indicators and chart patterns to identify these levels and incorporate them into their trading strategies.

Significance of Support and Resistance Levels in Forex Trading

- Identifying Key Price Levels: Support and resistance levels help traders identify key price levels where significant buying or selling pressure has previously occurred. These levels can act as reference points for traders, helping them make more informed trading decisions.

- Predicting Market Reversals: Support and resistance levels can also help traders predict potential market reversals. When the price approaches a support level, it may indicate that the downtrend is losing momentum, and a reversal to an uptrend may be imminent. Conversely, when the price approaches a resistance level, it may indicate that the uptrend is losing momentum, and a reversal to a downtrend may be imminent.

- Setting Stop-Loss and Take-Profit Levels: Traders often use support and resistance levels to set stop-loss and take-profit levels for their trades. A stop-loss level is a predetermined price level at which a trader will exit a losing trade to limit their losses. A take-profit level is a predetermined price level at which a trader will exit a winning trade to lock in their profits. By setting these levels based on support and resistance levels, traders can manage their risk and protect their capital.

- Planning Entry and Exit Points: Support and resistance levels can also help traders plan their entry and exit points for their trades. For example, a trader may decide to enter a long trade when the price breaks above a resistance level, as this may indicate that the uptrend is gaining strength. Similarly, a trader may decide to exit a long trade when the price approaches a resistance level, as this may indicate that the uptrend is losing momentum.

- Validating Other Technical Indicators: Support and resistance levels can also help traders validate other technical indicators. For example, if a technical indicator signals a buy signal, but the price is approaching a resistance level, the trader may be hesitant to enter the trade, as the resistance level may prevent the price from rising further. Conversely, if a technical indicator signals a sell signal, but the price is approaching a support level, the trader may be hesitant to enter the trade, as the support level may prevent the price from falling further.

Support and resistance levels are important concepts in forex trading because they help traders identify potential entry and exit points for their trades. These levels are formed based on previous price action and can shift over time as new information becomes available. Traders use various technical indicators and chart patterns to identify these levels and incorporate them into their trading strategies. By understanding the significance of support and resistance levels, traders can improve their trading decisions and increase their chances of success in the forex market.

Let’s Manage Your Forex Funds With Fx Pips Guru!

Fx Pips Guru is a forex fund management company managing client’s funds based on monthly profit share. Let’s do Live Chat with our experts.