The foreign exchange market (forex) offers a vast landscape for traders, but navigating the world of forex brokers can be challenging. When choosing a broker, understanding their execution model is crucial. This article delves into the concept of Electronic Communication Networks (ECNs) in forex trading and identifies characteristics of true ECN brokers in 2025.

What is an ECN and How Does it Work in Forex?

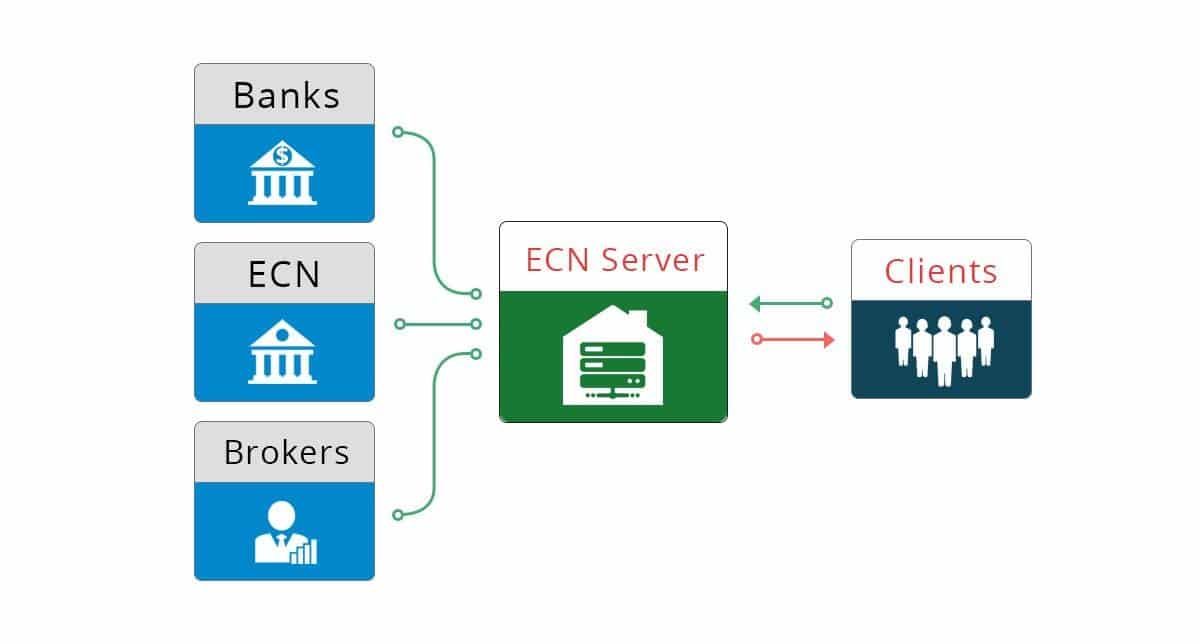

An ECN acts as an electronic platform that connects traders directly with a network of liquidity providers (LPs) – typically banks and other financial institutions. These LPs constantly quote bid and ask prices for currency pairs, creating a competitive marketplace for execution.

Here’s a simplified breakdown of how a true ECN forex broker operates:

- Trader Places an Order: You, the trader, submit a buy or sell order for a specific currency pair through your broker’s platform.

- Order Routing to ECN: The order is routed to the ECN, where it’s broadcasted to all connected LPs.

- Liquidity Provider Quotes: LPs respond with their best bid and ask prices for the requested currency pair.

- Order Matching: The ECN matches your order with the most favorable price offered by an LP.

- Order Execution: The trade is executed at the matched price, and the transaction details are reflected in your account.

Benefits of Trading with a True ECN Forex Broker

- Transparency and Fairness: ECNs promote transparent pricing as traders have direct access to LP quotes, eliminating potential broker intervention.

- Tight Spreads: ECNs generally offer tighter spreads compared to Market Maker brokers (more on that later) due to the competition among LPs.

- Fast Execution: Orders are typically executed swiftly as the ECN facilitates direct matching with LPs.

- No Dealing Desk Intervention: Unlike Market Makers, ECN brokers don’t profit from order flow disparity. They earn revenue through commissions charged per trade.

Identifying True ECN Forex Brokers

Unfortunately, not all brokers advertising ECN accounts operate as true ECNs. Here are some key factors to consider when evaluating a potential ECN forex broker:

- Execution Model Transparency: Look for brokers that clearly explain their execution model and provide details about their liquidity providers.

- Spread Structure: True ECNs typically offer variable spreads that fluctuate based on market liquidity. Beware of brokers offering consistently tight spreads, as this might indicate a Market Maker model.

- Commission Structure: ECN brokers usually charge commissions per trade volume. Compare commission fees across different brokers.

- Minimum Deposit Requirements: Many true ECN brokers have higher minimum deposit requirements compared to Market Makers. This is because ECNs cater to traders with larger trade sizes.

- Regulation and Reputation: Ensure the broker is regulated by a reputable financial authority and has a positive track record.

Beyond the Basics: Additional Considerations

While ECNs offer advantages, they also come with certain considerations:

- Slippage: Due to the dynamic nature of the market, orders might be filled at a slightly different price than requested (positive or negative slippage).

- Minimum Trade Size: Some ECNs have minimum trade size requirements, which might not suit traders with smaller accounts.

- Commissions: While commissions are generally low, they can add up for high-frequency traders.

Examples of Potential True ECN Forex Brokers in 2025

Disclaimer: It’s important to conduct your own research and due diligence before choosing a forex broker. This list is for informational purposes only and does not constitute financial advice.

1. Fusion Markets

Fusion Markets is a forex and CFD broker known for its low trading costs. They offer a wide range of tradable instruments including forex pairs, cryptocurrencies, indices, shares, and commodities. With a focus on accessibility, they have no minimum deposit requirement and provide platforms like MetaTrader 4 and 5 for trading. While their product selection is competitive, some users find the MetaTrader platform less user-friendly.

2. Pepperstone

Pepperstone is an established forex and CFD broker, known for its tight spreads and reliable trading platforms. They offer commission-free accounts with standard spreads or commission-based accounts with even tighter spreads.

Traders can choose from the popular MetaTrader 4, 5 and cTrader platforms, with the option to use them on desktop, web or mobile. Pepperstone is regulated in multiple jurisdictions for added security and is considered a highly trusted broker. They cater to various experience levels, from beginners to high-volume traders.

3. BlackBull Markets

BlackBull Markets is a reputable forex broker that offers a wide range of tradable instruments, including forex pairs, indices, commodities, and cryptocurrencies. With a focus on providing a seamless and efficient trading experience, BlackBull Markets boasts tight spreads, fast execution speeds, and a user-friendly trading platform. Their commitment to client satisfaction is evident through their excellent customer support and educational resources.

4. TMGM

TMGM is a reputable forex broker offering a wide range of tradable instruments, including forex pairs, indices, commodities, and cryptocurrencies. With a focus on providing a seamless and efficient trading experience, TMGM boasts tight spreads, fast execution speeds, and a user-friendly trading platform. Their commitment to client satisfaction is evident through their excellent customer support and educational resources.

5. Axi

Axi (formerly known as AxiTrader) is a globally recognized forex broker offering a range of trading services, primarily focusing on currency pairs but also covering other assets like commodities, indices, and cryptocurrencies. Established in 2007 and headquartered in Australia, Axi has grown into a reputable platform used by traders across the world, attracting both beginners and seasoned professionals.

6. GO Markets

GO Markets is a forex and CFD broker offering trading on over 1,000 instruments, including popular currency pairs, indices, commodities, and metals. They advertise tight spreads, leverage up to 500:1, and commission-free accounts.

GO Markets focuses on providing a user-friendly experience with platforms like MetaTrader 4 and 5, along with 24/7 multilingual customer support. They highlight segregated client funds and fast execution as trust-building measures. With a focus on regulation, competitive pricing, and platform accessibility, GO Markets positions itself as a potential solution for new and experienced traders looking to enter the CFD and forex markets.

7. FXTM

FXTM is a global online forex and CFD broker known for its diverse range of trading instruments, competitive pricing, and educational resources. They offer a variety of account types to suit different trading styles and experience levels, along with a user-friendly trading platform. With a strong focus on customer satisfaction, FXTM provides excellent support and educational materials to help traders of all levels succeed.

The Final Word

Choosing a true ECN forex broker can enhance your trading experience by providing transparency, tight spreads, and potentially faster execution. However, it’s vital to understand the specific features and drawbacks of ECNs before making a decision. By carefully evaluating brokers based on the criteria mentioned above, you can find a reliable partner for your forex trading journey in 2025.

Let’s Have Forex Trade Copying Service From Expert Traders!

Fx Pips Guru is a forex trade copying service provider company from expert traders. Let’s do Live Chat with our experts.