The foreign exchange market, or forex for short, is a dynamic beast. Currencies constantly fluctuate in value against each other, influenced by a complex interplay of economic factors, geopolitical events, and even market sentiment. Navigating this ever-changing landscape can be daunting for traders, but a powerful tool exists to help them make informed decisions: Time Series Forecasting (TSF).

TSF in Forex: Decoding Past Patterns for Future Predictions

At its core, Time Series Forecasts are a statistical technique that analyzes historical data points arranged chronologically, like exchange rates over time. By identifying patterns and trends within this data, TSF models attempt to predict future values. In the context of forex, this translates to forecasting the direction and potential magnitude of currency movements.

There are several advantages to employing Time Series Forecasts in forex trading:

- Improved Decision-Making: By anticipating future exchange rate movements, traders can make more informed decisions about entering or exiting positions. This can help them capitalize on profitable opportunities and mitigate potential losses.

- Identifying Trends: TSF models can highlight underlying trends in currency movements, allowing traders to ride the wave of a strengthening currency or exit before a weakening one.

- Risk Management: By understanding the potential range of future exchange rates, traders can implement better risk management strategies, such as setting stop-loss orders to limit potential losses.

Popular TSF Models for Forex Trading

Several TSF models are employed in forex trading, each with its strengths and weaknesses. Here’s a look at some of the most common ones:

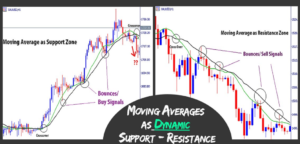

- Moving Averages: This is a simple yet effective technique that calculates the average price of a currency pair over a specific period. Different moving average lengths (e.g., 50-day, 200-day) can reveal short-term and long-term trends.

- Autoregressive Integrated Moving Average (ARIMA): This is a more sophisticated model that considers past price movements and statistical properties of the data to forecast future values. ARIMA models are particularly useful for stationary data, where the mean and variance remain constant over time.

- Exponential Smoothing: This technique assigns higher weights to more recent data points, making it more responsive to recent trends and price changes. Exponential smoothing is ideal for capturing short-term fluctuations.

- GARCH Models (Generalized Autoregressive Conditional Heteroscedasticity): These models address a crucial limitation of traditional models – volatility clustering. GARCH models capture the fact that periods of high volatility in forex markets tend to be followed by other periods of high volatility.

Beyond the Basics: Advanced TSF Techniques

While traditional TSF models offer valuable insights, the field is constantly evolving. Here’s a glimpse into advanced techniques gaining traction:

- Machine Learning (ML): Algorithms like Recurrent Neural Networks (RNNs) can analyze vast amounts of historical data and identify complex non-linear relationships between multiple variables, potentially leading to more accurate forecasts.

- Deep Learning: A subfield of ML, deep learning utilizes artificial neural networks with multiple layers to learn intricate patterns from historical data and generate more nuanced predictions.

- Hybrid Models: Combining traditional TSF models with ML or deep learning approaches can leverage the strengths of both, potentially leading to robust and adaptable forecasting systems.

Limitations of TSF and the Essential Disclaimer

Despite its capabilities, TSF has limitations that forex traders must be aware of:

- The Unpredictable Market: The forex market is inherently unpredictable, and unforeseen events can drastically alter currency movements. TSF models cannot account for every black swan event.

- Data Dependence: The accuracy of TSF models heavily relies on the quality and quantity of historical data used. Garbage in, garbage out applies here.

- Self-Fulfilling Prophecies: If a large number of traders rely on the same TSF model, their actions based on the forecasts can influence the market itself, potentially invalidating the prediction.

It’s crucial to understand that TSF is not a crystal ball. It’s a tool to be used in conjunction with other forex trading strategies, fundamental analysis, and technical indicators. Always prioritize your own risk management strategies and never base trading decisions solely on forecasts.

Leveraging TSF Effectively: A Trader’s Toolkit

Here are some key pointers to maximize the value TSF can provide in your forex trading endeavors:

- Combine TSF with Other Techniques: Don’t rely solely on TSF for your trading decisions. Integrate it with fundamental analysis, technical indicators, and your own market understanding for a well-rounded approach.

- Backtest Your Models: Before deploying a TSF model with real capital, test it on historical data to assess its accuracy and effectiveness. This helps identify potential weaknesses and fine-tune your model.

- Understand Model Limitations: Be aware of the limitations discussed earlier – the inherent unpredictability of the market, data dependence, and self-fulfilling prophecies. Don’t over-interpret forecasts and maintain healthy skepticism.

- Focus on Probability, Not Certainty: TSF models provide probabilities of future movements, not guarantees. Use forecasts to identify potential opportunities with high-probability setups, not chase surefire bets that don’t exist.

- Adapt and Evolve: The forex market is dynamic, and so should your TSF strategy. Regularly evaluate your models’ performance and adapt them as market conditions change. Explore new techniques and stay updated on advancements in the field.

Beyond Prediction: TSF for Risk Management

While predicting future exchange rates is a primary function of TSF, it also plays a crucial role in risk management. By analyzing historical volatility, TSF models can help you:

- Set Realistic Stop-Loss Orders: Estimate the potential range of future price movements and set stop-loss orders accordingly to limit potential losses if the market moves against your position.

- Identify High-Risk Periods: TSF models that factor in volatility clustering (like GARCH models) can highlight periods with historically high exchange rate volatility. This allows you to adjust your trading strategy during these times, potentially reducing exposure and mitigating risk.

- Optimize Position Sizing: Based on the predicted volatility and your risk tolerance, TSF can help you determine an appropriate position size for each trade, ensuring you don’t overexpose your capital.

TSF – A Powerful Tool in the Forex Trader’s Arsenal

Time Series Forecasts are a powerful tool that can empower forex traders to make informed decisions, identify trends, and manage risk effectively. By understanding the various TSF models, their limitations, and how to leverage them strategically, traders can gain a valuable edge in the ever-changing forex market. Remember, TSF is a tool, not a holy grail. Use it wisely, combine it with other strategies, and always prioritize risk management for a more sustainable and successful trading journey.

Let’s Manage Your Forex Funds With Fx Pips Guru!

Fx Pips Guru is a forex fund management company managing client’s funds based on monthly profit share. Let’s do Live Chat with our experts.