The allure of foreign exchange (forex) trading lies in its potential for high returns. However, this fast-paced market also carries inherent risks. To navigate these waters successfully, setting realistic and achievable goals is crucial. Ambitious but unrealistic targets can lead to frustration, impulsive decisions, and ultimately, financial losses. So, how do you chart a course through well-defined achievable forex trading goals?

The Power of SMART Goals

The SMART framework provides a strong foundation for crafting effective forex trading goals. SMART stands for:

- Specific: Clearly define your goal. Instead of a vague desire to “make money,” aim for a “15% increase in account value over the next three months.”

- Measurable: Quantify your goal with a specific metric. You can measure progress by tracking percentage gains, pip targets (percentage in points), or a reduction in drawdown (maximum decline from a peak).

- Achievable: Be honest with your experience and skill level. Don’t expect overnight success. Aim for gradual progress that builds confidence and competence.

- Relevant: Ensure your goals align with your overall financial objectives. Are you saving for a specific purpose, or aiming for a long-term income stream?

- Time-bound: Set a timeframe for achieving your goal. This creates a sense of urgency and helps you track progress.

Prioritizing Process Over Outcome

While profit is a natural goal in forex trading, focusing solely on outcomes can be counterproductive. The market is inherently unpredictable, and chasing specific returns can lead to reckless trading behavior. Instead, prioritize process-oriented goals that emphasize developing your skills and improving your trading discipline.

Here are some examples of process-oriented goals:

- Master a specific technical indicator: Dedicating time to understand and implement a technical indicator like Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) can enhance your trading decisions.

- Backtest your trading strategy: Simulate your trading plan using historical data to assess its effectiveness and identify areas for improvement.

- Maintain a consistent trading journal: Record your trades, analyze your entries and exits, and identify recurring patterns in your wins and losses. This self-reflection fosters continuous learning and adaptation.

- Develop emotional control: The forex market can be emotionally charged. Set a goal to manage your emotions and avoid impulsive decisions based on fear or greed. Techniques like meditation or journaling can help.

Understanding Your Risk Tolerance

Forex trading involves inherent risk. Setting goals that align with your risk tolerance is paramount. Ask yourself:

- How much capital can you afford to lose? Never risk more than you can comfortably lose. Start small and gradually increase your position size as your skills and confidence grow.

- What is your comfort level with drawdowns? A drawdown is a decline in your account value from a peak. Set a risk management strategy, like stop-loss orders, to limit potential losses and protect your capital.

Setting Realistic Targets

When setting profit targets, consider these factors:

- Average market returns: Historically, forex markets have offered modest but consistent returns. Research realistic expectations based on current market conditions.

- Your experience level: Beginners should prioritize learning and risk management over chasing high profits.

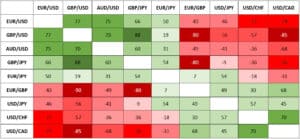

- Volatility of the currency pair: More volatile currency pairs offer the potential for higher returns but also carry greater risk. Choose pairs that align with your risk tolerance.

Aligning Goals with Your Trading Strategy

Your trading goals should work in tandem with your overall trading strategy. Here’s how:

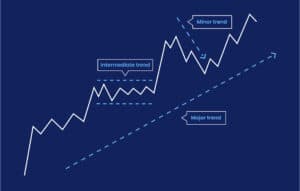

- Scalping vs. Swing Trading: Are you aiming for short-term gains through scalping or targeting longer-term trends through swing trading? Set goals that align with your chosen strategy’s timeframe and profit potential.

- Technical vs. Fundamental Analysis: Do you base your trades on technical indicators or fundamental economic factors? Ensure your goals reflect the timeframe and potential returns associated with your chosen analysis style.

Continuous Monitoring and Adjustment

The forex market is dynamic. Regularly assess your progress and adjust your goals as needed. Here’s how:

- Track your performance: Monitor your progress against your set metrics. Are you on track to achieve your goals within the timeframe?

- Review your trading journal: Analyze your past trades and identify areas where you can improve your entries, exits, and risk management.

- Adapt to market conditions: The forex market is constantly evolving. Be prepared to adjust your goals and strategy based on changing economic factors and market trends.

Let’s Manage Your Forex Funds With Fx Pips Guru!

Fx Pips Guru is a forex fund management company managing client’s funds based on monthly profit share. Let’s do Live Chat with our experts.